Most investors are aware that seasonal patterns exist in equities, but they may not be as familiar with the seasonal patterns in fixed income markets. History has shown that stocks have been relatively weak in August and September. Can core fixed income investors glean anything from a traditionally volatile period for equity markets? Because of the seasonal patterns in equity markets, changing investor risk sentiment in August could make core bonds more attractive as they represent a less volatile option than stocks and a higher yielding alternative than cash.

“We still think high-quality bonds play a pivotal role in portfolios as they have shown to be the best diversifier to equity risk,” reports LPL Financial Fixed Income Strategist Lawrence Gillum. “While we expect further gains for stocks through year-end, unforeseen events happen. And it’s best to have that portfolio protection in place before it’s needed.”

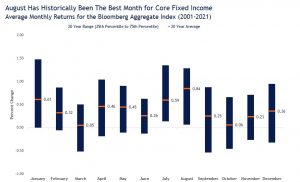

As seen in the LPL Chart of the Day, some months appear more or less favorable for core fixed income, as measured by the Bloomberg U.S. Aggregate Bond index, with August generally being the best performing month. On average, the index was up 84 basis points (0.84%) in August, which was nearly 50 basis points higher than the average monthly return of 37 basis points over all months. Moreover, since 2001, the range of monthly returns generated in August were generally positive, which means core fixed income has done a good job of offsetting some of the equity losses during an otherwise volatile month.

(Source: LPL Research, Bloomberg, 8/15/22)

Whether the seasonal patterns in the equity or fixed income markets persist this year or not (and we are certainly not making a market call), we still think owning core bonds in a diversified portfolio makes sense. The fact that fixed income markets have performed best in August, when equity market volatility has tended to increase, is no coincidence. Core bonds have historically been the best diversifier to equity market risk. And while we still like equities over bonds over the course of the year, we do think high-quality fixed income continues to serve a purpose in portfolios despite likely modest returns.

Important Disclosures:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Tracking # 1-05315325