InVestra utilizes a client-centric process focused on pursuing specific milestones we create together. Our comprehensive process is designed to help identify your needs, implement your strategy and monitor it to help you stay on course. These costs can either be billed to you or be deducted directly from the accounts we manage.

Wealth Managers at InVestra are available to review your plans and discuss questions at any time – it’s our passion to help. There are no extra charges for phone calls, emails, or meetings when you are a client. In addition to our immediate services, you also have access to your accounts, consistent advice, access to our e-newsletter, client appreciation events, seminars (virtual and in-person), and monthly market updates sent to you via email. We also understand that legacy planning is important and we like to support that effort by offering a complimentary consultation for your child or grandchild.

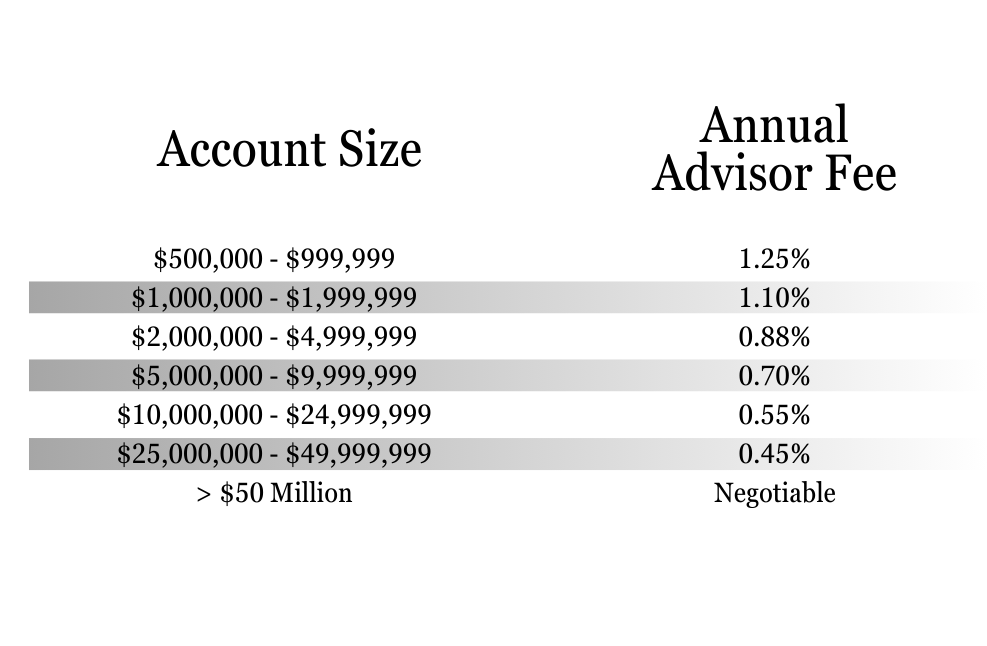

Fee amounts are determined following an evaluation of the complexity of your financial situation and the specific aspects of your financial life you wish to address. This fee covers the design of the plan and twelve months of follow-up services, including any necessary meetings and phone calls. Most of our clients opt to renew their contracts with us annually to continue benefiting from our ongoing, proactive supervision of their financial matters.

In certain instances, we offer client consultations on an hourly basis. This arrangement might involve a “second opinion” to review an existing plan or address specific issues that don’t necessitate a full financial plan. We’ve assisted in locating old life insurance policies, evaluating retirement plans (such as 401ks and 403bs), consolidating antiquated stock certificates, assessing and managing old savings bonds, analyzing real estate transactions, and providing various other services under this arrangement. The acceptance of such consultations depends on our availability and ability to meet your specific needs. The cost for this service begins at $250 per hour, with a minimum requirement of three hours. To inquire about costs, fees, rates, commissions, or payment details, please Book Time With Us.

This information was developed as a general guide to educate clients and is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. We offer non-core services on a case-by-case basis. The referenced fees are for estimated purposes only. All fees are discussed and agreed upon in writing, including charges.