In November, rating agency Moody’s announced that it had downgraded is credit rating outlook on U.S. government debt from stable to negative. They cited wide budget deficits and political polarization as reasons for the downgraded view. Further, Moody’s noted amid higher interest rates, without measures to reduce spending or boost revenue, fiscal deficits will likely “remain very large, significantly weakening debt affordability”.

Moody’s is the last of the three main rating agencies with a top rating on the U.S. debt after Fitch downgraded the U.S. government in August following the latest debt-ceiling battle. S&P Global Ratings was the first to cut the rating for the U.S. in 2011 amid that year’s debt-limit crisis. Since the announcement though, Treasury yields are generally lower (prices higher) across the curve.

In our view, the bond market’s collective shrug for the outlook change affirms that rating agencies are only catching up to the fiscal policy challenges that the bond market has been pricing in for several quarters. In fact, until recently, the market has been trading primarily on the expected increase in Treasury supply to fund budget deficits expected over the next several years. Per the Congressional Budget Office, the U.S. government is expected to run sizable deficits over the next decade in the tune of 5%-7% of GDP each year, which means a lot of Treasury issuance is coming to market.

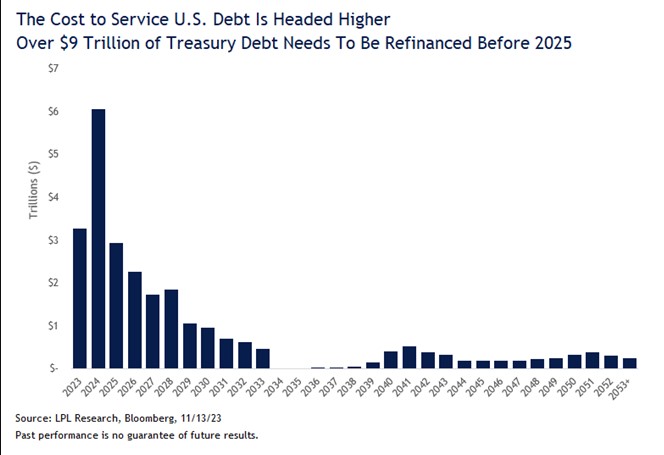

That is obviously a lot of supply that needs to find demand. However, since we know the U.S. rarely (if ever?) actually pays its debts off, there is also a lot of existing debt that needs to be rolled over as well. Over the next 13 months, the U.S. will need to refinance over $9 trillion of debt with over $3 trillion due this year. The additional supply comes at a time when price-insensitive buyers are stepping back from the Treasury market. The supply/demand imbalance will likely mean interest rates are going to be higher than they otherwise would be absent sizeable deficits.

These refinancings will take place with interest rates among the highest in over a decade. So, with the recent announcement that interest expense on existing debt hit $1 trillion, interest expense is likely only headed higher—concerns that were outlined by Moody’s (and Fitch in August). So, frankly, it’s no surprise that rating agencies, in general, have started to sound the alarm that fiscal risk is rising. Importantly though, in our view, the downgrades do not suggest the U.S. will have trouble paying its debts; we think there is currently a very low probability of default. But, until the U.S. government gets its fiscal house in order, we’re likely going to see additional downgrades and likely higher interest rates in the Treasury market.

IMPORTANT DISCLOSURES:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Tracking # 505497