Do you find the acronyms CRT, CRUT, CRAT, and NIMCRUT confusing? If so, you’re not alone. But once you understand the basic structure of a charitable remainder trust (CRT), understanding the other types of charitable giving becomes easier. Many charitable trusts begin with the CRT concept: A grantor moves assets to a trust and receives immediate tax benefits and income from the assets during his or her lifetime. At the grantor’s death or at a designated time in the future, the remaining assets of the trust are given to the charity named as the trust’s beneficiary. But why the variety of trusts and acronyms? Charitable remainder annuity trusts (CRATs), charitable remainder unitrusts (CRUTs), and net income charitable remainder unitrusts with makeup provisions (NIMCRUTs) are all types of CRTs. The differences among them are in the form of the income stream and how that income may best serve the grantor’s needs.

Potential Benefits of CRTs

- Diversify highly appreciated assets without triggering capital gains taxes

- Immediate income tax deduction

- Receive income from the CRT during your lifetime

- Benefits the charity of your choice

Roles of Wealth Management Professionals

Your financial advisor’s role is to support everyone, not to replace anyone. Your financial advisor will work with you and your tax and legal advisors, helping to coordinate and communicate your complete financial picture. The drafting of your trust document will be done by your estate planning attorney, and can be administered once it’s properly drafted. This way, you can continue to benefit from the judgment of your trusted financial advisor, while your family’s wealth is managed by a knowledgeable trustee.

The Trustee: A CEO for Your Estate

The trustee’s role is to administer and distribute the assets in the trust according to your wishes, as expressed in the trust document. There are three primary elements to the trustee’s role:

- Custody of Assets – The custodial role is that of a financial secretary and security guard. The trustee must identify and then take title to the trust’s assets, keep accurate records, report to the current beneficiaries, execute and settle all transactions, protect and insure the property, and defend the trust against claimants. The trustee oversees the preparation of appropriate tax returns and all of the trust accounting in compliance with complex state and federal laws.

- Asset Management – The trustee is ultimately responsible for the preservation and investment of assets in the trust, ensuring that invested assets are productive and managed appropriately given the trust’s objectives. The trustee has the legal responsibility to reassess the objectives of the trust and current market conditions at least annually, and to be sure that the investments match those objectives. Trustees will often hire professional managers to handle day-today specialized activities, such as real estate management. The day-to-day investment management is delegated to your trusted financial advisor.

- Administration – The administrative role is central to carrying out your wishes regarding the use of assets in the trust. The trustee carries out your directions and follows your guidelines in handling the specific circumstances of each request for funds from trust beneficiaries. This involves legal interpretation of the language in the document and appropriate input from family members. Experienced and objective trust administration and recordkeeping are vital components to implementing your plan. The day-to-day relationship management is also handled by your trusted financial advisor.

Trustees may have to make tough decisions that might not be popular with all your beneficiaries. After all, the trustee is carrying out your instructions, not your beneficiaries’ wishes. This can be a difficult role to fulfill for a family member, who may not be unbiased or may wish to act in a manner that avoids hard feelings within the family, rather than carrying out your instructions. Also, few family members have investment management skills or expertise in fiduciary law and practice. Family members can be given important advisory roles, such as in approving disbursements or other exercises of discretion.

The Benefits of Naming a Professional Trustee Include:

- Objective loyalty and independence to carry out your wishes

- Knowledgeable management and defense of trust assets

- Experienced oversight of the investment process to be carried out by your financial advisor

- Timely and accurate statements of the account to keep you and all current beneficiaries informed

- Consistent annual reviews

- Accountable collection and prudent distribution of income and assets

- Tax reporting, filing, and comprehensive regulatory compliance on behalf of the trust

Donor Advised Funds

Since we’ve laid out the basics of Charitable Remainder Trusts, let’ next take a look at Donor Advised Funds and how you can use them for better giving. Similar to a CRT, a Donor Advised Fund is a charitable investment account that allows a donor to make gifts to their favorite charities and gain immediate tax benefits, and is administered by a public charity that is created to manage charitable donations on behalf of organizations, families, or individuals.

CRTs only exist for a specific time span – usually lifespan of the donor. During that time span, the donor (or their beneficiaries) are enjoying the income interest from the CRT. When it ends, the remaining assets become a remainder interest that are deposited into a Donor Advised Fund. The DAF becomes the “remainderman” of the CRT. Then, the donor is able to make grants from their fund to support their favorite charitable causes. Throughout the process, the donor’s financial advisor remains involved, overseeing the investments in the CRT and the DAF, providing consistent investment guidance. Here’s how it works:

Give – The Donor contributes assets into a DAF as an irrevocable gift. Gifts can be completed with liquid assets (cash and/or appreciated securities). Some DAF administrators will also accept liquid assets.

Get – The DAF Administrator is a qualified charity; therefore, the donation is considered a completed gift for tax purposes and the donor may be eligible to account for the donation as an itemized income tax deduction.

Grow – Assets in the DAF can be invested and any growth is tax-free, under the ownership of the DAF Administrator, for the purpose of funding future charitable grants. The Donor recommends the investment allocation. Some Administrators allow the Donor to hire an Investment Advisor.

Grant – The Donor requests grants from the DAF to other qualified charitable organizations. The Donor recommends amounts, timing, and recipients. Grants can be requested during the Donor’s lifetime or during the lifetime of a Successor Donor. Timing can also be requested to occur at the Donor’s death.

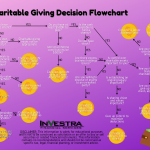

Read through our decision-making helper flowchart to see which form of charitable giving might be the option for you.

Important Disclosures: This material was created by InVestra Financial Services for the use of InVestra Financial Services. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through InVestra Financial Services, a registered investment advisor and separate entity from LPL Financial. LPL Financial and InVestra Financial Services do not offer tax or legal services.

LPL Tracking | #1-05147210