When it comes to investing, the quest for the perfect timing can often lead to frustration and uncertainty. However, there’s a strategy that can help investors navigate market volatility and take advantage of price fluctuations without the need to time the market accurately. Enter dollar-cost averaging, a simple yet powerful approach to long-term investing. In this article, we will explore the appeal of dollar-cost averaging, its benefits, and how it can be a smart way to remove emotions from investing while eliminating the challenges of market timing. Fun Fact: It is referred to as “pound-cost averaging” by our friends in Europe.

A Simple yet Systematic Approach

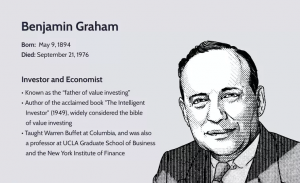

Dollar-cost averaging (or DCA, as we may refer) quite straightforward. By investing the same amount of money at regular intervals, regardless of market conditions, you automatically buy more shares when prices are low and fewer shares when prices are high. In his book “The Intelligent Investor” where Benjamin Graham coined the term for DCA himself, he states “Dollar-Cost Averaging means simply that the practitioner invests in common stocks the same number of dollars each month or each quarter. In this way, he buys more shares when the market is low than when it is high, and he is likely to end up with a satisfactory overall price for all his holdings.” This systematic approach eliminates the need to predict market movements and removes the emotional element from investing decisions. Implementing dollar-cost averaging is as simple as setting up automatic investments at a consistent interval, such as monthly contributions, making it easy for investors to maintain a disciplined investment approach.

An Example

You have $600 that you want to invest in an equity mutual fund. Should you invest it all at once, or spread your purchases out over increments of $100 for six months? Take a look at this scenario that shows the potential benefits of dollar-cost averaging.

Month Investment Share price Shares bought

1 $100 $10 10

2 $100 $8 12.5

3 $100 $5 20

4 $100 $10 10

5 $100 $16 6.25

6 $100 $10 10

If you invested your $600 in the first month, you would have purchased 60 shares at $10 per share. If you used dollar-cost averaging over six months, you would own a total of 68.75 shares, and the average price you would have paid per share would be $8.72.

Taking Advantage of Those Market Fluctuations

One of the key appeals of dollar-cost averaging is its ability to take advantage of market fluctuations. During periods of market downturns, when prices are lower, your fixed investment amount buys more shares. Conversely, when markets are experiencing highs, your fixed investment buys fewer shares. Over time, this approach averages out the purchase price of your investments, potentially reducing the impact of market volatility. By consistently investing regardless of market conditions, you can benefit from accumulating shares at a lower average cost!

Stepping Back From Emotion

Investing can be an emotional rollercoaster, leading to impulsive decisions driven by fear or greed. Dollar-cost averaging helps eliminate the emotional element by adhering to a predetermined investment plan. Instead of reacting to short-term market fluctuations, you stay focused on your long-term goals and maintain a disciplined approach. By consistently investing at regular intervals, you remove the temptation to time the market or make impulsive decisions based on temporary market conditions, increasing the likelihood of achieving your financial objectives.

Mitigating Risk

Dollar-cost averaging can be a prudent risk management strategy, particularly when investing in assets prone to volatility. By spreading your investments over time, you reduce the risk of making significant investments at the peak of market cycles. While dollar-cost averaging does not guarantee profits or protect against losses, it provides investors with the opportunity to accumulate assets at different price points, potentially lowering the average cost basis and reducing the overall investment risk.

Long-Term Focus and Consistency

Dollar-cost averaging encourages a long-term perspective on investing. By consistently investing over time, you benefit from the compounding effect and the potential for growth in your investment portfolio. This approach also fosters discipline, as it encourages investors to stay committed to their investment plan, irrespective of short-term market fluctuations. By focusing on the long term and remaining consistent in your investment approach, you are more likely to achieve your financial goals.

In short, dollar-cost averaging can be an appealing investment strategy for long-term investors because by consistently investing the same amount of money at regular intervals, they’re able to take advantage of market fluctuations, remove emotional decision-making, and mitigate risk. This systematic approach simplifies investing, eliminating the need to time the market accurately. By adopting dollar-cost averaging, you can maintain a disciplined investment approach, increase the potential for favorable average costs, and further enable yourself to continue to build wealth over time. Remember, investing is a long-term journey, and dollar-cost averaging can be a great tool to utilize on that path to financial success.

Important Disclosures:

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes.

LPL Tracking | #452870-1