We received our final reading on Consumer Price Index (CPI) inflation for 2022 recently, which gave us the inflation numbers for December 2022. Helped by declining energy prices, the index fell 0.1% in December, in line with economists’ consensus expectation and the largest monthly decline since April 2020. Consumer inflation advanced less than 1% over the second half of 2022, although the fight against inflation is far from over.

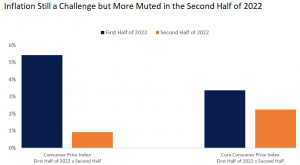

Year over year, inflation fell to 6.5% in December, down from 7.1% in November, in line with the consensus expectation. But as seen in the LPL Chart of the Day below, most of that advance came over the first half of the year, which will roll off the year-over-year number as we advance into 2023. The index only advanced 0.9% over the last six months of the year, the lowest six-month reading since late 2020.

However, just as inflation readings were lifted in the first half of the year by rising energy prices, they have been pulled lower by falling energy prices. Core inflation, which excludes food and energy, also slowed over the second half of the year, but less dramatically. Core inflation climbed 0.3% in December and overall slowed from 3.4% over the first half of 2022 to 2.2% over the second half.

The early reaction to the largely in line numbers from both stock and bond markets was muted, with market participants already pricing in expectations for further slowing over the last few trading days. But it can take time for markets to fully digest the report and we’ve seen large swings on CPI day over the last year. According to Bloomberg analysis, the S&P 500 moved an average of 1.9% on CPI day in 2022, about three times the average over the prior five years. A line-up of Federal Reserve (Fed) speakers today may also shape the reaction over the rest of the day.

Some other highlights:

- Energy prices fell 4.5% in December, the fifth decline in the last six months. Because energy prices are volatile, changes don’t provide a strong picture of underlying inflation trends, but it still provides some relief for consumers.

- Monthly increases in shelter prices, up 0.8% in December, continue to be a large contributor to core inflation. But as noted by Fed Chair Jerome Powell, shelter prices tend to react to the real-time price environment with a lag and can be somewhat discounted when looking at underlying trends.

- While food costs overall increased 0.3% in December, prices for dairy and fruits and vegetables fell.

While inflation has slowed, the Fed is still fighting several important battles to make sure we don’t experience the yo-yo inflation of the 1970s. Inflation expectations can impact prices and some of the Fed’s steadfast inflation-fighting rhetoric has been to keep inflation expectations well anchored, something they’ve largely succeeded at thus far. Labor markets also remain fairly tight despite slow economic growth. While the Fed doesn’t want to unnecessarily damage the economy, getting inflation levels sustainably back toward their long-term trend will probably require wage gains to slow further. Finally, a strong dollar helped control inflation for U.S. consumers by making goods from abroad less expensive. A weaker dollar may create some added inflationary pressure.

The Fed will continue to have a lot of leeway to focus on inflation as long as labor markets remain relatively strong. The Fed’s “dual mandate” is low and stable prices and maximum employment. While growth has slowed, labor markets remain strong. Job creating has slowed but labor demand is still adding to wage pressure and the unemployment rate remains quite low at 3.5%. But bottom line, the weakening trend of inflation should convince the Fed to further downshift the pace of rate hikes in the upcoming meeting. The Fed will likely hike rates by 0.25% on February 1. The labor market must significantly cool before the Fed could appease markets by cutting rates the latter half of this year. Our base case is the economy will slow enough for the Fed to consider cutting rates sometime in the second half of this year.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

LPL Tracking #1-05355320