Headline Inflation Jumps, Core Inflation Cools

Headline inflation in May rose 8.6% from a year ago, accelerating from April’s 8.3% growth rate. The Consumer Price Index (CPI) rose to the highest year-over-year increase since December 1981. The spike in consumer prices were fairly broad-based but especially noticeable in gas and groceries. “Higher food costs will especially hit lower income consumers with another 1.4% increase in food prices from just one month ago,” warned LPL Chief Economist Jeffrey Roach. Dairy prices rose 2.9% month-over-month, the largest monthly increase since July 2007. A moderation in food prices will not likely come to fruition until geopolitical risks subside and sanctions expire.

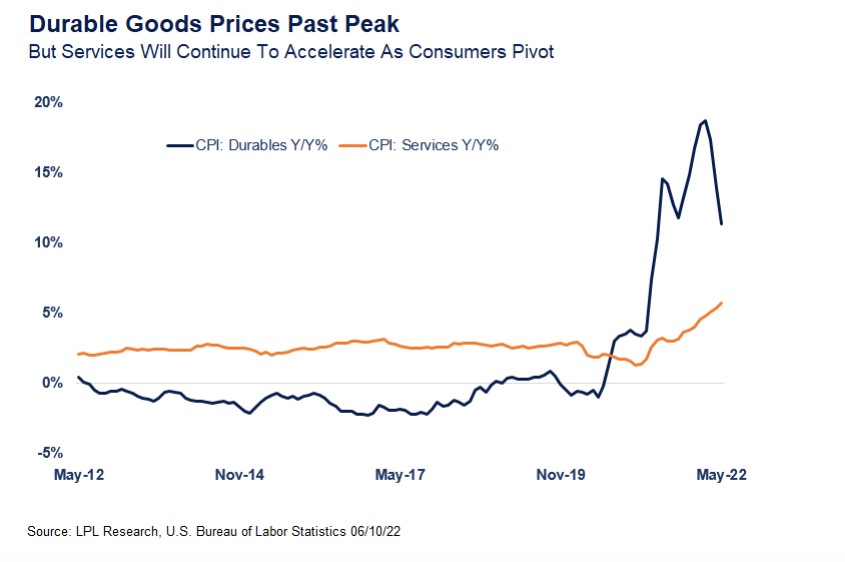

Airline tickets jumped another 12.6% after gaining 18.6% last month, as airlines deal with pilot shortages and high fuel costs. As consumers pivot to more services spending, travel-related consumer prices will likely take a longer time to moderate relative to goods prices.

We do see some cooling in prices, particularly in durable goods. As shown in the LPL Chart of the Day, durable goods prices continue to decelerate, supporting the narrative that we are past peak in at least some categories. The core CPI (excluding food and energy) fell to 6.0% from a year ago, down from 6.2% last month and reaching a four-month low.

Policy Makers Inclined To Hike More For Longer

Before today, our base case for the Federal Funds target interest rate at the end of this year was 2.50%, which roughly matched the estimated neutral rate for the Federal Reserve (Fed). However, the nagging persistence of some consumer prices might change plans for the Fed. The Fed is widely expected to raise rates by 50 basis points next week but now, the odds are increasing that the Fed will also raise rates another 50 basis points in July. Before today, we expected the Fed to raise by 25 basis points in July but we may update our expectations. Futures markets are now pricing in a 50 basis point hike in September as well.

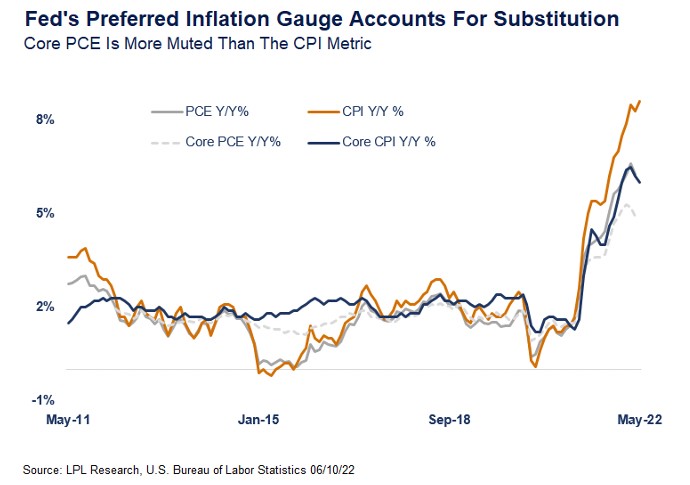

Investors and policymakers know inflation will likely stay above target for an extended period but both will focus on the direction of the change. The Federal Reserve’s preferred inflation gauge is the Core Personal Consumption Expenditure (PCE) deflator and we could likely see a more definitive decline in the deflator when released later this month. The Fed prefers the deflator metric because the CPI does not account for product substitutions consumers make when prices change, whereas, the PCE deflator tracks price changes of actual consumer purchases.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Tracking # 1-05290200