Given the recent pauses in interest rate hikes by both Canada and the US, some investors are now anticipating a potential end to rate increases and the possibility of rate cuts in 2024. This shift in market dynamics has brought fixed-income (bond) investing to the forefront, particularly as falling yields traditionally lead to rising bond prices. While contemplating the opportune moment for bond investments, it’s crucial to grasp the tax treatment of bonds and the concept of the ‘GIC Equivalent Yield.’

Understanding Bonds

Bonds are debt instruments that provide regular interest payments at a fixed rate, typically on a semi-annual or annual basis. The “coupon rate,” or initial yield, is set at the time of bond issuance and aligns with prevailing market interest rates. The bond’s principal, known as the “face value” or “par value,” represents the amount the issuer commits to repay upon maturity. Traded actively on the secondary market, bond prices are influenced by issuer credit quality and the variance between the bond’s coupon rate and current market interest rates for similar time horizons.

Bond Pricing Scenarios

- Buying a Bond at Par:

- Acquiring a bond at its face value, paying the specified amount at issuance, often in multiples of $100.

- Buying a Bond at a Premium:

- When market interest rates decline post-issuance, the bond price rises, and investors pay a premium, attracted by the higher coupon.

- Buying a Bond at a Discount:

- If interest rates rise after issuance, holding a bond with a lower interest rate than prevailing market rates may result in selling the bond at a discount (below face value)

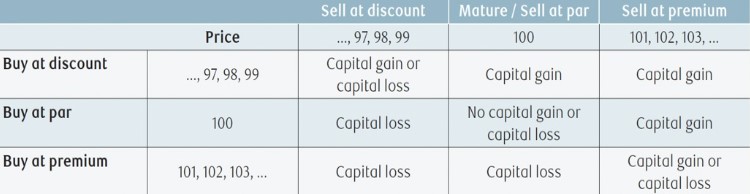

This table summarizes the potential capital gain or loss implications of selling a bond paying regular interest.

Considering Yield % and Yield to Maturity:

The “Yield %” or “Yield to Maturity” of a bond indicates the return when held to maturity. Bonds with a yield encompassing both capital gains and interest coupons may offer a better after-tax return than those with only interest coupons. Capital gains are taxed at a lower rate than interest income. Hence, a discounted bond with a lower coupon than a new GIC might yield a better return (i.e., yield to maturity) than a GIC.

To assess the ‘Taxable Equivalent Yield‘ or ‘GIC Equivalent Yield‘ of potential bond investments, contact us. In the current environment, buying a discounted bond and holding it to maturity is likely to leave more money in your pockets after taxes compared to a GIC, making discount bonds a timely investment.

As investors, a comprehensive understanding of bond pricing and returns is essential. To navigate fixed-income investments and optimize your bond strategy effectively, book time with your CPA and one of InVestra’s Wealth Advisors.