Rating agencies have been busy lately. While one of the big three (Fitch) made headlines recently when it downgraded U.S. government debt, the other two (Moody’s and S&P) have been busy quietly downgrading U.S. corporate debt at an elevated pace. With the increase in Treasury yields over the past few years, corporate interest payments are set to increase as well. And while the health of the corporate landscape is generally positive, rating agencies are starting to adjust their outlooks based upon, among other things, the expected increase in debt payments.

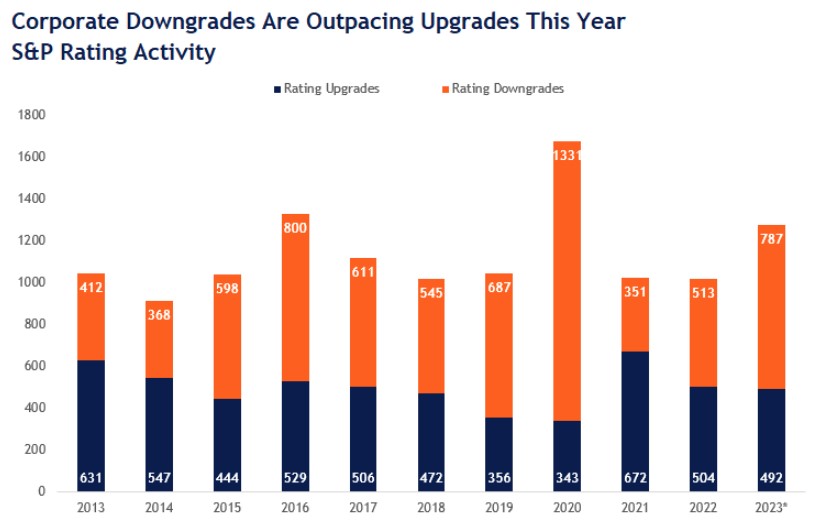

The ratings environment remains relatively calm for companies across investment grade as the asset class has enjoyed an upgrade-to-downgrade ratio well above lower-rated peers. High yield has taken the brunt of downgrades and will likely continue to in the coming quarters. September marked the 15th straight month with a negative combined upgrade-to-downgrade ratio, as the measure between S&P and Moody’s finished the month at -1.2x (meaning there were 20% more downgrades than upgrades). Moody’s remained more pessimistic, with the ratio at -1.4x. S&P had an upgrade-to-downgrade ratio of -1.1x. Year to date, S&P has downgraded its outlook and the outright rating on 787 companies versus only 492 upgrades, which makes 2023 already the worst year for downgrades since 2020 (Moody’s has downgraded 568 companies this year vs. 427 upgrades).

*Through 10/05/2023 Source: LPL Research, Bloomberg, 10/11/23 Past performance is no guarantee of future results.

With the higher for longer narrative coming from the Federal Reserve (Fed), it’s likely corporate debt payments will continue to increase as well. And while many corporate borrowers took advantage of low interest rates and issued a lot of debt, debt refinancings are set to pick up with nearly 30% of debt issued by CCC-rated companies coming due over the next few years (as outlined in this blog post). As such, we remain cautious on corporate credit broadly but think the short-to-intermediate part of the investment grade corporate credit curve offers compelling risk/reward. However, despite the recent sell-off in high yield, we still don’t think the risk/reward is very attractive for that asset class given the broader macro and refinancing risks, which will likely keep rating downgrades and defaults at an elevated pace.

IMPORTANT DISCLOSURES:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing. Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Tracking # 490510