It’s a hot topic! In late September, the U.S. dollar hit a 20-year high in an index that measures its value against six major currencies: the Euro, the Yen, the Pound, the Canadian dollar, the Krona, and the Franc. At the same time, a more broad inflation-adjusted index that captures a colllection of 26 foreign currencies reached its highest level since 1985! Both indexes have slowed down slightly since then but remained near those highs all throughout October (MarketWatch, October 19, 2022, U.S. Dollar index).

So it might seem that a strong dollar is good for the U.S. economy, but the effects are mixed when you consider it in the context of other domestic and global pressures.

The World Standard

The U.S. dollar is the world’s “reserve currency,” meaning about 40% of global financial transactions are executed in dollars, with or without U.S. involvement (NY Times, September 26, 2022). That said, foreign governments, global financial institutions, and multinational companies all hold dollars, providing a level of demand regardless of other forces.

Demand for the dollar tends to increase during difficult times as investors seek stability and security. Despite high inflation and recession predictions, the U.S. economy remains the strongest in the world (Wall Street Journal, October 17, 2022). Other countries are battling inflation too, and the strong dollar is making their battles more difficult. The United States recovered more quickly from the pandemic recession, putting it in a better position to stay strong against inflationary pressures.

The Federal Reserve’s aggressive policy to combat inflation by raising interest rates has driven demand for the dollar even higher because of the appealing rates on dollar-denominated assets such as U.S. Treasury securities. Some other central banks have begun to raise rates as well — to fight inflation and offer better yields on their own securities. But the strength of the U.S. economy allows the Fed to push rates higher and faster, which is likely to maintain the dollar’s advantage for some time.

Exports and Imports

The strong dollar makes imported goods cheaper and exported goods more expensive. Cheaper imports are generally good for consumers and for companies that use foreign-manufactured supplies, but they can undercut domestic sales by U.S. producers.

At the same time, the strong dollar effectively raises prices for goods that U.S. companies sell in foreign markets, making it more difficult to compete and reducing the value of foreign purchases. For example, a U.S. company that sells 10,000 euros worth of goods to a foreign buyer would receive less revenue when a euro buys fewer dollars. Some experts are concerned that the strong dollar will dampen the post-pandemic rebound in U.S. manufacturing (Wall Street Journal, October 9, 2022). More broadly, the ballooning trade deficit cuts into U.S. gross domestic product (GDP), which includes imports as a negative input and exports as a positive input.

Global Exposure

Generally, large multinational companies like Apple and Amazon have the most exposure to risk from currency imbalances, and the stock market has shown signs of a shift from these large companies, which have dominated the market since before the pandemic, to smaller companies that may be more nimble and less dependent on overseas sales. The S&P SmallCap 600 index has outperformed the S&P 500 index through October; if the trend continues through the end of the year, it would be the first time since 2016 that small caps have eclipsed large caps (Wall Street Journal, October 17, 2022). The S&P MidCap 400 index has done even better. In the context of the bear market, better performance means lower losses — all three indexes have had double-digit losses through October 2022 (S&P Dow Jones Indices, 2022).

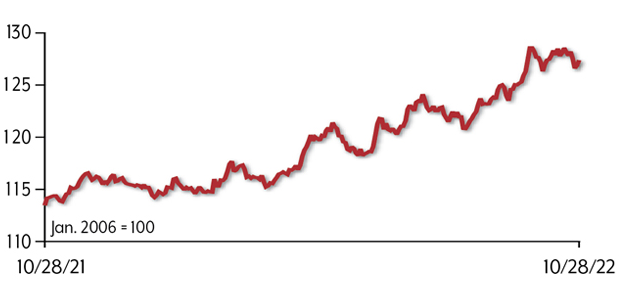

Over the past year, the value of the dollar has risen rapidly! (Nominal Broad US Dollar Index).

Global Strain?

A weak currency can be a blessing for a country by making its exports more competitive, but with the world economy weakening other countries are not reaping those benefits and are having to pay more on debt and imported essentials such as food and fuel that are traded in dollars. The Fed is focused on domestic concerns, but it is effectively exporting inflation while trying to control it at home, and global economic pain could ultimately spread to the U.S. economy (New York Times, September 26, 2022).

A Great Time for an Overseas Vacation!

Economic experts say that in the near term, the Fed’s aggressive rate hikes may reduce domestic demand for foreign goods, reducing the trade deficit and weakening the dollar, and the advanced Q3 2022 GDP estimate showed the trade gap closing, but it’s unclear if the trend will last.

In the longer term, as inflation eases in the United States, the Fed will likely take its foot off the gas and ultimately bring rates down. This would allow other central banks to catch up (if they choose to do so) and would make foreign currencies and securities more appealing. Lower oil prices (in dollars) and/or any reduction in world tensions — such as a slowdown in the Russia-Ukraine conflict— may also help reduce demand for dollars (U.S. Bureau of Economic Analysis, 2022).

Since these are such complex dynamics it may take time for any of them to unfold, but in the meantime, the strong dollar is a sign of U.S. economic strength, so this could be a great time for an overseas vacation!