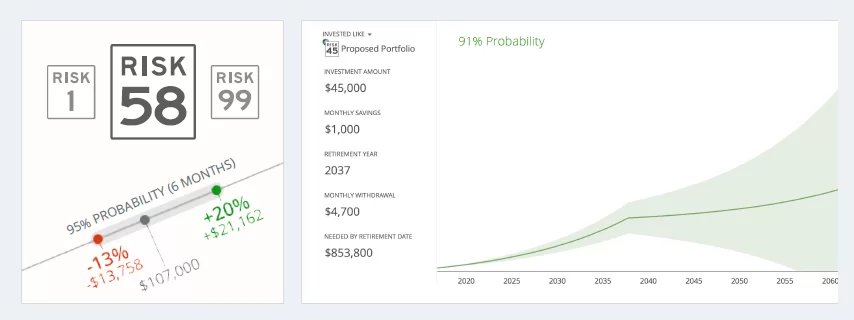

Ambiguous terms such as “conservative” and “moderately-aggressive” cause confusion in the investment arena. This uncertainty benefits no one in the advisor-client relationship. Generalizing client risk tolerance does not work.

Investors view risk through their own, unique lens to gauge risk and return tradeoffs. Finding a Risk Number allows for an objective measure for clients and wealth managers to deepen communication.

What’s Your Risk Number?

Individuals are always evaluating their current location and discerning where they’re headed. In the same way, knowing your Risk Number helps you see what risk you currently have, how much risk you’re willing to handle, and how much risk you need to hit your goals.

Need Guidance? Let’s Build Your Financial Future

I’m here to help you understand your Risk Number and create a strategy tailored to your goals.