National 401(k) Day is a day of importance since it prompts us to check in on our nest egg. Unless you’re the type who wants to work until age 90, you’ll need a plan for your retirement years. After all, it’s nearing the end of 2022, and the days of company pensions are long gone, and Social Securoty can only get you so far.

In order to feel confident that you’re properly prepared for retirement, understanding exactly what you can do to make your dream retirement come to fruition is crucial. Why? The more you understand about your future retirement needs and the ways to work towards those goals, the better prepared you will be.

That’s why InVestra is here to facilitate conversations about 401(k)s between consumers and providers, raising awareness of the facts and making a connection that will ultimately pay off for both parties.

A Brief History

The Profit Sharing/401(k) Council of America (PSCA), known today as the Plan Sponsor Council of America, is who primarily began to push education on this subject back in 1996. The Friday following Labor Day (Monday) was selected with the notion that employees could “start the week with Labor Day and end the week with Retirement.”

Since t retirement savings education can be such a complex topic, the PSCA encourages companies to give their employees the run-down about their 401(K) in fun, easy-to-comprehend ways, which we’ll share with you here today!

Side note: because of this complexity and our ever-increasing focus on our financial health and wellness over recent years, many companies campaign for retirement savings education year-round. What many don’t realize is that 401(k) plans aren’t the only way to have a solid plan for retirement savings; since not everyone has access to them and many people prefer investment diversification, there are many options for retirement savings than all of our nest eggs in one 401(k) basket.

The Basics

If a 401(k) is available to you through your employer, you can use it as a resource to start your retirement plan. However, if you’re self-employed, you can start one through a financial institution. There are two different types of 401(k)s – traditional and Roth. The traditional route takes a percentage of your paycheck – approved by you, of course – whereas through the Roth 401 (k), contributions are made with money you’ve already paid on taxes, meaning that any earnings are tax deferred and qualified withdrawals of earnings are tax-free.

Many don’t realize 401(k) plans aren’t the only way to have a solid plan for retirement saving; since not everyone has access to them and many people prefer investment diversification, there are many options for retirement savings than all of our nest eggs in one 401(k) basket (see above).

This graphic shows the distribution of ages of active participants – meaning it’s never too early or too late!

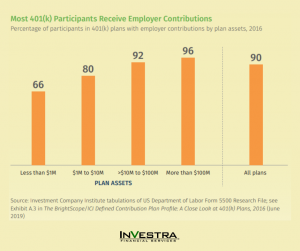

And it may be more common than you think for employers to match so generously.

What to Do Next

In order to feel confident that you’re financially prepared for retirement, understanding exactly what you can do to make your dream retirement come to fruition is the foundation you need in order to make it happen: The more you understand about your future retirement needs and the ways to reach those goals, the more prepared you’ll be – hello, golden years.

Find a Retirement Calculator

Many financial groups offer a Retirement Calculator Tool on their website, typically free for anyone to use. Fill in your personal information to get an estimate on how much money you will need to live on each year in retirement and whether or not your current savings plan is on track to provide that amount.

Know Your Numbers

Use this holiday as a reminder to check in on your assets. Is your savings plan panning out as you had hoped? Are you reaching your annual savings goals? What adjustments need to be made. This is something you should track periodically so mark your calendar for National 401(k) Day to do just that!

Learn Over Lunch

Seek out learning events you could attend that may be hosted by your bank, credit union, or even your employer. Go online or get a book on retirement preparation at the library. With just a little bit of effort, you can begin your research to get on track for a more enjoyable retirement.

IMPORTANT DISCLOSURES: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. Withdrawals of Roth IRA earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through InVestra Financial Services, a registered investment advisor and separate entity from LPL Financial. Insurance products are offered through LPL or its licensed affiliates.