Preferred securities are one of the best-performing asset classes this year, with the ICE Core Plus Fixed Rate Index up over 13% year to date. Moreover, index yields remain elevated so these securities could be an attractive option for income oriented investors. In general, preferreds offer generous yields, both absolute and after-tax, with their high-income stream serving as a total return buffer against future spread volatility. As such, preferred securities can be higher yielding alternatives to traditional core fixed income options. They are concentrated in the financial sector, but since the global financial crisis, many financial institutions have emerged with stronger balance sheets, which should limit downgrades and defaults, in our view.

Following are five things investors should know before allocating to preferred securities.

- Hybrid securities. Preferred securities are “hybrid” securities that can be classified as either equity or debt within a company’s capital structure. They are senior to common equity, but junior to traditional debt. As such, they don’t have the same capital appreciation potential of common equity, nor do they possess the same capital preservation benefits of traditional debt. Preferred securities, then, tend to offer higher coupon payments to attract investors.

- Financial focus. The majority of issuance comes from financial institutions. Preferred securities are highly correlated with the health of the financial system and a shock to the financial system would adversely impact these securities.

- Credit risk. The securities tend to be BBB- or BB-rated, meaning they carry higher levels of credit and default risks than the senior debt issued by the same issuer. However, since the issuers of preferred securities tend to be higher quality companies, default rates have been lower than similarly rated non-financial corporate bonds.

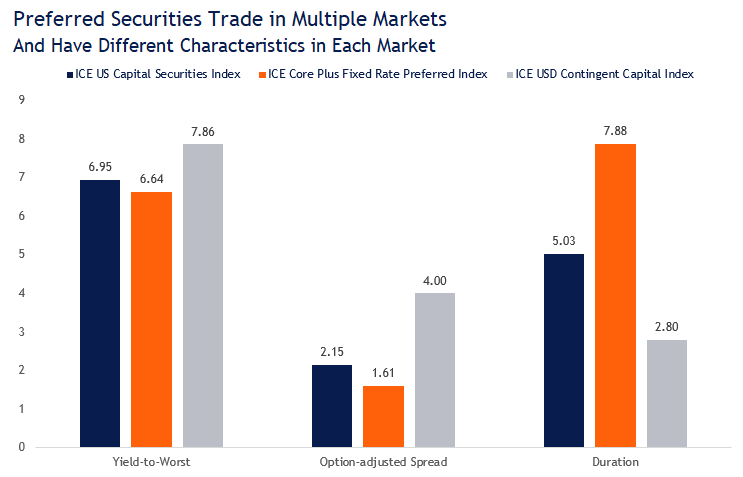

- Multiple markets. As seen below, preferred securities trade in different markets and while the issuer could be the same, the individual security characteristics can be different. The $25 retail market (ICE Core Plus Fixed Rate Index) is an exchange-traded market where the securities generally have longer durations and lower yields, whereas the $1000 institutional market (ICE US Capital Securities Index) is an over-the-counter traded market where the securities pay dividends semi-annually. Finally, non-U.S. issuers trade primarily in yet a different market (ICE USD Contingent Capital Index) with different characteristics and different risk premiums.

Source: Bloomberg 2/21/23. All indexes are unmanaged and cannot be invested directly. Past performance is no guarantee of future results.

- Diversification benefits. Given the hybrid nature of preferred securities, there are diversification benefits to adding preferred to a portfolio. While these securities tend to “act” like equity and high-yield fixed-income securities across a full market cycle, since the financial crisis in 2009, these securities have generally held up better than both during equity market sell-offs (as measured by the S&P 500 Index)

Despite the lower earnings environment for financials this year (75% are issued by banks and insurance companies), the fundamental health of the financial system remains intact. These financial institutions can likely weather any potential recessionary storm while continuing to pay dividends on their preferred securities. So, for those income-oriented investors willing to take on some additional credit risk, preferred securities might be an attractive investment to consider.