Supply Chain Stability Comes at a Cost

As the long-term effects of the pandemic continue to unfold, one trend that has been adopted by multinational companies is to repatriate their supply chains in an effort to avoid future disruptions. In both the U.S. and in developed international countries, companies are increasing their focus on supply chain resiliency which often comes with higher material and labor costs. Inflation pressures are already hitting margins, and revenue growth is slowing, making this a challenging transition.

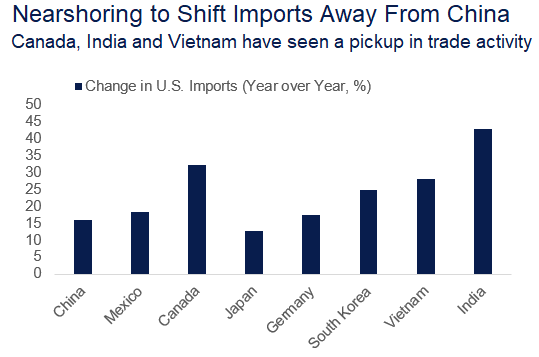

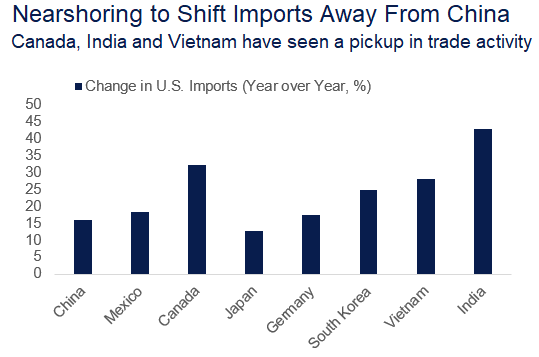

Within Asia, geopolitical tensions have encouraged movement away from China and into other countries within emerging markets. This shift has been welcomed by countries like India where exports to the U.S. increased 43% year-over-year and Vietnam where exports to the U.S. increased by 28% year-over-year in 2021, as shown in the chart below (LPL Research, 2023).

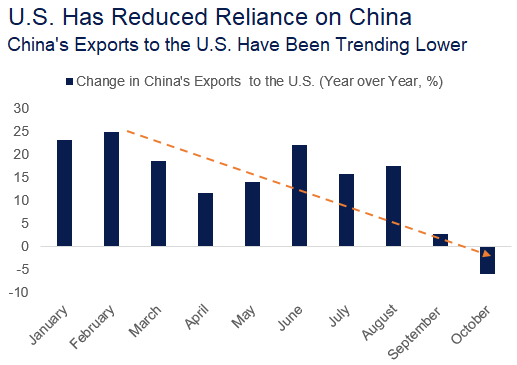

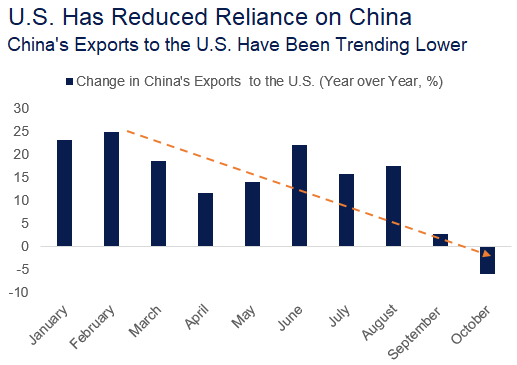

While imports from China into the U.S. broadly increased in 2022, the year-over-year rate of change has slowed and even turned negative in October:

U.S. firms are also nearshoring to Mexico and Canada in an effort to minimize the potential for supply chain disruptions without dramatically increasing input prices and labor costs. The U.S. has begun to increase imports from both countries, with Tesla’s (TSLA) announcement of a significant investment in Mexico as a recent example.

Reshoring and nearshoring increase the potential for margin compression as increased input and labor costs erode earnings. While insulating supply chains from disruption have the potential to improve total revenues as supply constraints abate, we would expect margins to come under pressure when supply chains are moved closer to home. Profit margins for S&P 500 Index companies have already narrowed by more than one percentage point over the past year and, depending on the path of inflation, could narrow further.

China’s reopening could work to offset some of the trends that defined 2022. For instance, the China Manufacturing Purchasing Manager’s Index (PMI) released this week surprised to the upside as manufacturing moved into expansionary territory with China’s reopening. As supply chains are reworked, geographic shifts in demand will be an important area of focus.

Given geopolitical risks, as well as earnings weakness and an uncertain path for the U.S. dollar, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains an underweight recommendation to emerging market equities. Alternatively, STAAC maintains a positive view on the industrials sector, which could stand to benefit from the increased investment in domestic supply chains.

Important Disclosures:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All information is believed to be from reliable sources; however, LPL Financial & InVestra FInancial makes no representation as to its completeness or accuracy. All performance referenced is historical and is no guarantee of future results. This material was prepared for the use of InVestra Financial Services. Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

LPL Tracking | # 1-05362051

Share This Story, Choose Your Platform!