Investors love to chase returns! In the near term, it can potentially be a successful strategy that has some strong academic and industry research behind it, but nothing lasts forever.

“Once a segment of the market has underperformed for a decade, it is often so hated many investors actively avoid it,” – Barry Gilbert, LPL Asset Allocation Strategist

Markets move in cycles: the more a segment of the equity market outperforms, the greater the potential it has to become mispriced as sentiment runs ahead of fundamentals. Sentiment can run hot for a long time, and there are no rules for how long these cycles may last, but at some point, there’s typically a just desert. Historically, a decade has often been long enough to see some of these meaningful reversals. Based on history, outperformers over the last 10 years tend to be underperformers over the next 10 and vice versa.

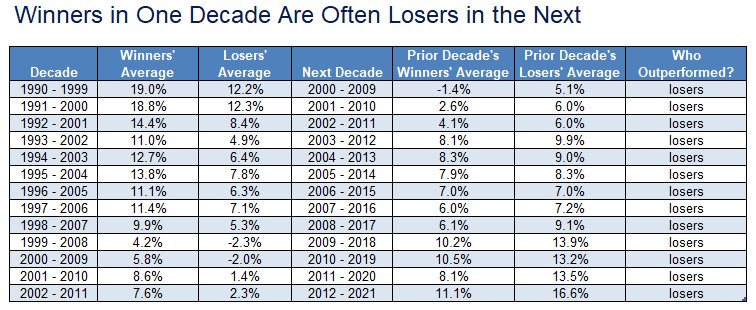

Here we have a study that suggests that the right thing to do when positioning tactically may not be the same as the right thing to do when positioning strategically, but taking advantage of that difference takes patience. As shown in the chart below, looking at 22 major segments of the equity market, outperformers in one decade became underperformers over the next decade over every rolling period, starting with the comparison of 1990-1999 and 2000-2020. In fact, an average of 6.0% of outperformance from the winners in the starting decade became an average of 2.8% of outperformance from the prior losers in the next!

Source: FactSet, 7/26/22. Indexes include Russell 1000, Russell Mid-Cap, Russell 2000, and their corresponding growth and value indexes, S&P 500, MSCI EAFE, MSCI Emerging Markets, and S&P Dow Jones Select Sector indexes for communication services, consumer discretionary, consumer staples, energy, financials, health care, industrials, materials, tech, and utilities.

So what were the underperformers from 2012-2021 that may be potential outperformers over the next decade? It looks like a sorry list considering the last decade, but that’s the point. For long-term investors, these areas may be worth considering for mean reversion opportunities.