Inflation and tapering have been dominating the conversation lately and it shouldn’t be much of a surprise. Here we’ll be touching on why the threat of inflation remains so transitory and discuss our outlook for stocks the remainder of this year, along with why Developed International could finally be looking like a sustainable investment, after years of underperformance.

Stocks Outlook

It was on March 23, 2020, when the S&P 500 hit its bottom after the Covid crisis sent the equity benchmark tumbling 30% in 22 days, the biggest decline in such a short period. As of late, The Dow, S&P 500, and Nasdaq have all been hitting fresh highs, March turned out to be the best month for equities since November, big tech stocks have rebounded, and May, historically a strong month for stocks, was off to a strong earnings start. After a huge start to this bull market, history would say year 2 would probably be fairly solid as well, but expect more volatility. No year 2 of a new bull market has been lower since World War II and we don’t expect that trend to end this time around. With massive fiscal and monetary policy, along with an incredible jump in earnings, it’s tough to stay that stocks are ahead of themselves. It seems that the record jump in earnings helps to justify current levels and likely continued equity strength. However, in the second half of the year, as inflationary pressures build, interest rates potentially rise further, and this bull market gets a little older, the pace of stock market gains will likely slow and come with more volatility. See below.

Taper Time?

The Fed minutes opened the door for the possibility of tapering, which might catch you off guard, but it shouldn’t. Remember, ‘tapering’ is the initial reduction of the rate at which a central bank accumulates new assets on its balance sheet under a quantitative easing policy aiming to theoretically reverse said QE policy with the goal of stimulating economic growth after the QE has had its desired effect [of stimulating and stabilizing the economy]. A recent example of attempted tapering was that which followed the massive QE program implemented by the Federal Reserve in reaction to the Financial Crisis of 2008 when they initiated a plan to lower the amount of assets purchased each month if economic conditions, such as inflation and unemployment were favorable. That said, the Fed is buying $120 billion worth of Treasuries and Mortgage Backed securities each month, and tapering simply means they will start to buy less each month. The big worry is that inflation runs hotter than expected and the Fed is caught behind the 8 ball and has to hike rates sooner than expected. We do expect tapering sometime later this year, and it could be announced later this summer, with the actual tapering taking place in early 2022. With the economy firmly recovering, it’s a normal part of the healing process.

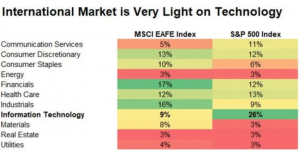

Finally Time for Developed International?

Developed International, specifically Europe, has lagged behind the U.S. for multiple decades and could soon see much of the explosive growth that the U.S. and part of Asia have recently experienced as[ Europe] eventually gets the pandemic under control. In addition, Europe’s primary make up is value centric, which could be another tailwind as value does better during the reopening. Lastly, it’s valuable to realize that for 20 years that Europe has gone essentially nowhere from a technical perspective; there could be plenty in the tank for Europe to continue to move higher, as it has formed a multi-decade base.

Source: LPL Research, 5/21/21. US equity market represented by S&P 500 Index. Developed international equity market represented by MSCI EAFE Index. All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

IMPORTANT DISCLOSURES:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change. References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. All index and market data from FactSet and MarketWatch. This Research material was prepared by LPL Financial, LLC for the use of InVestra Financial Services. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Investment advice offered through InVestra Financial Services, a registered investment advisor and separate entity from LPL Financial.

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

LPL Tracking | #1-05148492